Travel Insurance Analysis

Objective

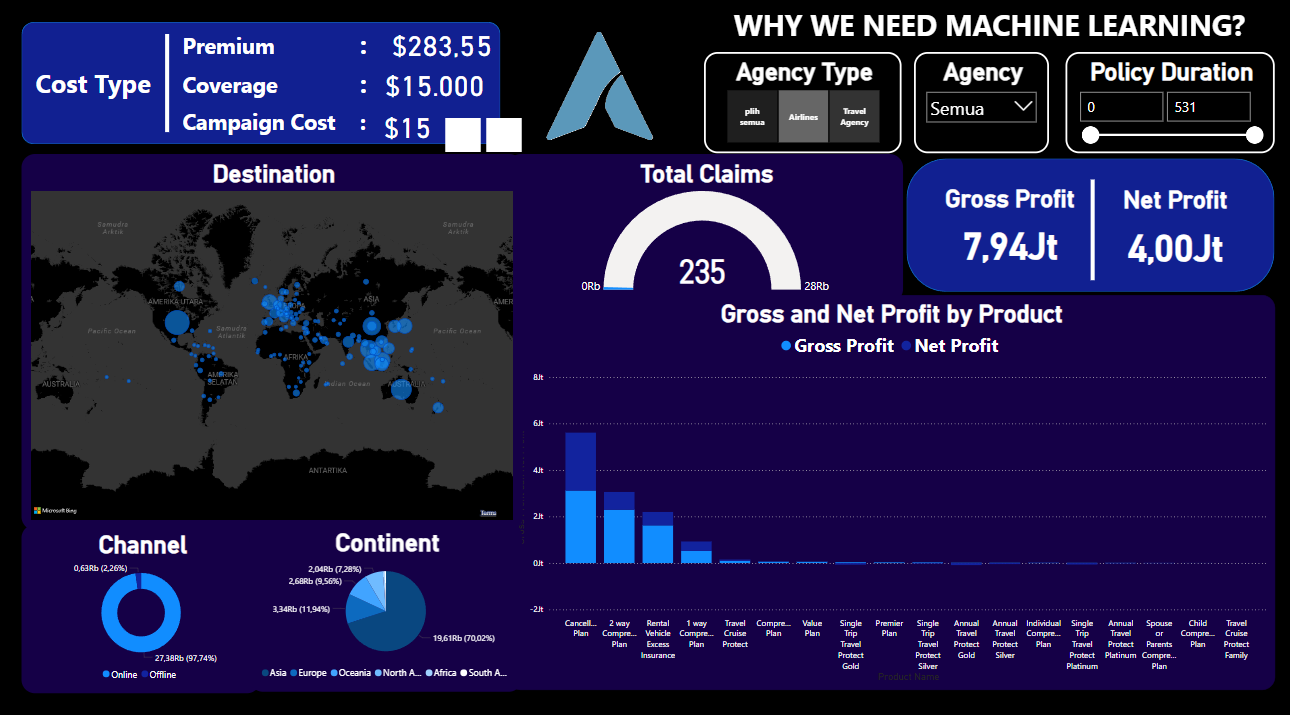

To develop a robust machine learning model to predict the likelihood of travel insurance claims, enabling insurance companies to proactively manage risks, optimize resource allocation, and improve customer satisfaction through tailored products.

Challenges

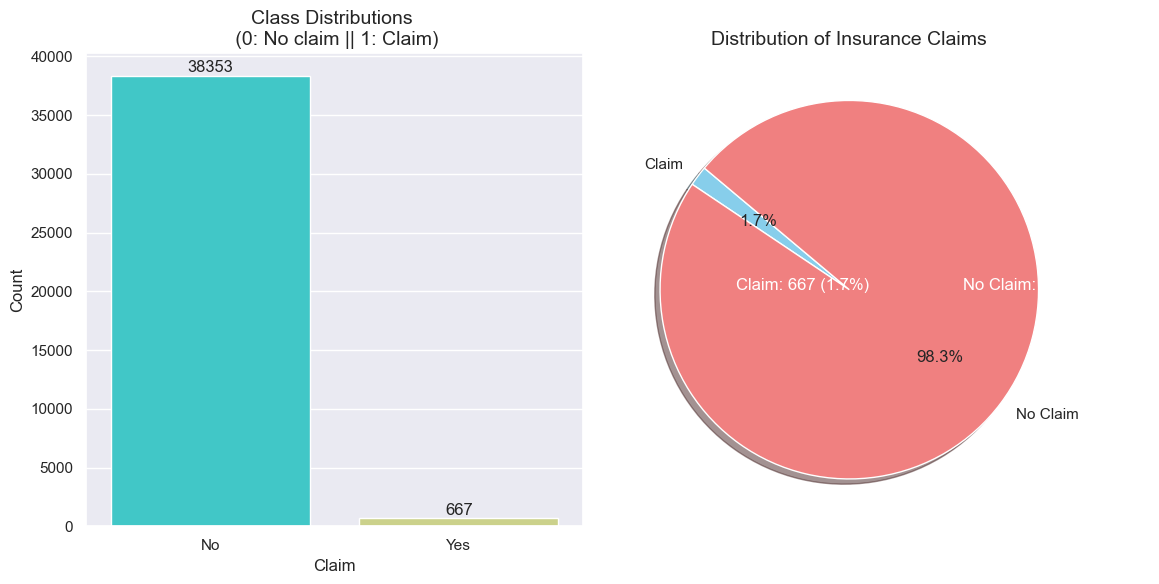

- Predicting claims in a highly imbalanced dataset (98.5:1.5 ratio of non-claimants to claimants).

- Identifying key factors influencing claims using explainable AI to improve decision-making.

- Enhancing resource allocation by predicting future claims accurately.

Methodology

- Utilized the Travel Insurance dataset with historical data of policyholders.

- Built an XGBoost model to handle imbalanced data and predict claims.

- Applied explainable AI techniques to interpret the model and highlight the most significant factors for claim prediction.

- Achieved a 95% recall rate to minimize false negatives and improve operational efficiency.

Analysis

Key factors influencing the likelihood of travel insurance claims included:

- Duration of Travel

- Age of Insured

- Destination of Travel

- Sales Channel

By analyzing these factors, the model successfully predicted claim likelihoods and provided insights into resource allocation.

Summary

By using machine learning, we increased profit from S$100,764.20 to S$392,959.95, demonstrating a significant improvement due to the model’s ability to reduce false negatives and better predict claims.

View on GitHub Power BI Dashboard Analysis